Ownership Structure of the Group

Ownership Structure

Shareholders' Equity and Ownership Structure

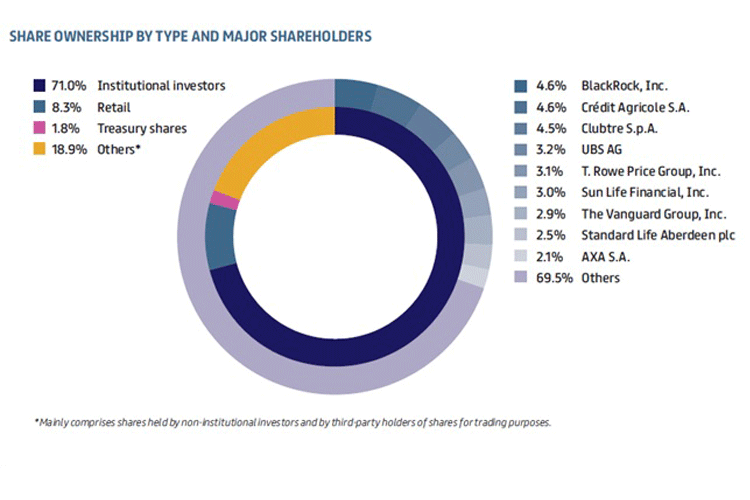

Ownership structure by type and major shareholders

TThe Company's free float was equal to 100% of the outstanding shares and major shareholdings (in excess of 3%) accounted for approximately 21% of total share capital, meaning there were no majority or controlling interests. Prysmian is now one of Italy's few globally present industrial concerns to have achieved true Public Company status in recent years.

Source: Nasdaq OMX December 2019

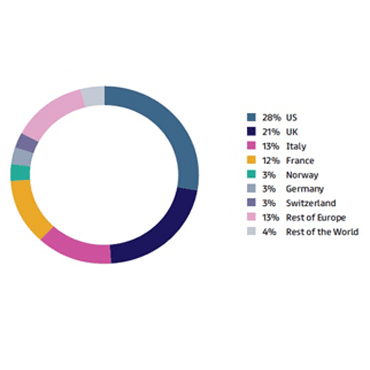

Institutional investors by geographical area

The geographical ownership structure shows a predominant presence of the United States, which represents 28% of the institutional investor total, followed by the United Kingdom, which accounted for 21%, both basically the same as the previous year. Italy accounted for around 13% of the capital held by institutional investors, down from 2018, while France’s share was slightly higher than the year before at about 12%. The proportion of Asian investors (primarily from Japan and Hong Kong) was basically stable.

Source: Nasdaq OMX December 2019

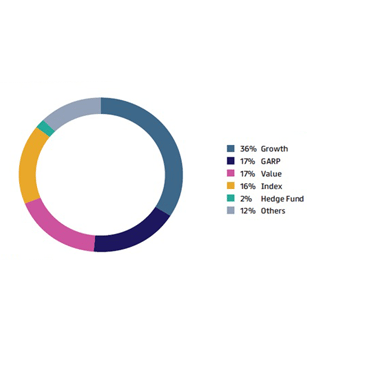

Institutional investors by investment approach

Approximately 70% of the share capital held by institutional investors is represented by investment funds with Value, Growth or GARP strategies, therefore focused on a medium to long-term investment horizon. The proportion of investors adopting an Index investment strategy, based on the principal stock indexes, was stable compared with 2018, while the Hedge Fund component, focused on a shorter time horizon, decreased in weight to 2% of the total.

Source: Nasdaq OMX December 2019